Therefore the Final Chargeable gain is RM230000 RM10000 RM220000. You do not want the tax to eat up most of the proceeds from your sale.

John Bogle S Book List We Continue Our List Of Famous Investor Books With Recommends By John Or Jack Bogle In This Topstories I Book Lists Investing Books

Property sold after 6th year 5.

. It is chargeable upon profit made from the sale of your land or real property where the resale price is higher than the purchase price. Find millions of books from trusted sellers around the world. The tax would have been higher if he had sold the property within less than 5 years.

The disposer is devided into 3 parts of categories as per Schedule 5 RPGT Act. Yes based on Budget 2019 and 2020 all gains obtained after 6th years of the Sales Purchase date shall have a capital gain tax of 5 for citizenPR and 10 for non-citizenNon-PR and companies. The act was first.

Hence Larrys RPGT payable would be as low as RM 15615. Property purchase sold within first 3 years 30. 2013 RPGT 2014 RPGT 1st year 15.

What is the base year valuation for property purchased 6 years before January 2020. The most recent RPGT amendments in lieu of our Budget 2019 announced by Ministry of Finance MOF Malaysians who are selling off their property in the sixth and subsequent years of ownership will now have to pay a 5 RPGT. The base year for the Real Property Gains Tax RPGT has been revised to Jan 1 2013 for assets acquired before the date from Jan 1 2000 previously.

Thus it is vital to consider RPGT before selling your property. RPGT Act Through The Years 1976 2022 RPGT is a tax on profit. LAWS OF MALAYSIA Act 169 REAL PROPERTY GAINS TAX ACT 1976 An Act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto.

Disposal in 6th year and beyond. Disposal of assets to REITs and Property Trust Funds. That means it is payable by the seller of a property when the resale price is higher than the purchase price.

All You Need To Know About Real Property Gains Tax Rpgt Income Estate Capital Gains Tax Hikes Retirement Account Crackdown House Finally Details How It Will Fund 3 5 Trillion Social Policy Plan. Foreigners and companies will also see an increase in RPGT rates from 5 to 10. Net Chargeable gain RM230000 x 10 RM23000 Max exemption Amount is RM10000.

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News. RM 50000 RM 250000 x 20. Part II Schedule 5 RPGT Act.

Properties that are disposed within four years of purchase are subjected to 20 tax and 15 for five years. Property Disposal in. RPGT is generally classified into 3 tiers.

In the above example where your gain was RM250000 the RPGT payable would be RM 50000. Someone once said A person doesnt know how much he has to be. There is an exemption for 10 of net chargeable Gain or RM10000 per transaction whichever is lower and capped at maximum RM10k.

This fact is specified in the Real Property Gains Tax Act 1976 Act 169. Disposal of assets in connection with securitisation of assets. Ad Buy books anywhere anytime.

According to the Real Property Gains Tax Act 1976 RPGT is a form of Capital Gains Tax in Malaysia levied by the Inland Revenue LHDN. Real Property Gains Tax RPGT Payable. RPGTA was introduced on 7111975 to replace the Land Speculation Tax Act 1974.

For example individual Malaysian citizen and partners. Gain accruing to an individual who is a citizen or a permanent resident in respect of the disposal of one private residence. To find out more on the Allowable expenses for RPGT read Real Property Gains Tax RPGT 2021-2022 in Malaysia.

Malaysia Real Property Gains Tax RPGT is a tax imposed by the Inland Revenue Board LHDN on chargeable gains which find their source in the disposal of real property. Both Acts were introduced to restrict the speculative activity of real estate. Property purchase sold on 5th year 15.

An amount of RM10000 or 10 of the chargeable gain whichever is greater accruing to an individual. In Larrys case the applicable rate of RPGT in Malaysia is 5 for he had owned the property for ten years which is above six years. Understanding How Real Property Gains Tax RPGT Applies to You in Malaysia 3 February 2016 by Lim Jo Yan and Mak Ka Wai RPGT is a tax chargeable on the profit gained from the disposal of a property and is payable to the Inland Revenue Board.

Real property gain tax calculation formula 3 Formula 3. To prevent speculative investment RPGT threshold is divided into years of ownership and type of entities. Larrys Net Final Chargeable Gain x Applicable Rate of Real Property Gains Tax RPGT RM 312300 x 5 RM 15615.

It is chargeable upon profit made from the sale of your land or real property where the resale price is higher than the purchase price. As of 2021 the several updates regarding RGPT announced during PENJANA 2020 were gains from the disposal of residential properties after 1 June 2020 until 31 December 2021 will be exempted from RPGT. As such RPGT is only applicable to a seller.

Property purchase sold on 4th year 20. A 2021 insight into Real Property Gain Tax in Malaysia. Part 1 Schedule 5 RPGT Act Except part II and part III.

In general Real Property Gain Tax RPGT is applicable to all residents as long as a profit is made from selling their property within Malaysia be it whether they are Malaysian citizens or foreigners. 7 November 1975 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan Agong with the advice and consent of the Dewan Negara. Property purchase sold within the first 5 years 30.

The 2014-Malaysia Property Gain Tax Rate for foreigners is the same for local Malaysians as follows. After the Budget 2014 announcement RPGT has been increased substantially to 30 for properties sold within 3 years or less previously it was 15 for 2 years and below and 10 for 3 years and below 20 for properties disposed within 4 years of purchase and 15 for 5 years previously it was 10. Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976.

Starting from January 1st 2014 all properties disposed within three years or less is subjected to 30 RPGT previously 15 for two years and below and 10 for three years and below. According to the Real Property Gains Tax Act 1976 RPGT is a form of Capital Gains Tax in Malaysia levied by the Inland Revenue LHDN. Real Property Gains Tax RPGT Rates RPGT rates differs according to disposer categories and holding period of chargeable asset.

Disposal of chargeable asset pursuant to a scheme of financing approved by the Central Bank of Malaysia Labuan FSA Malaysian Co-operative Societies Commission or the Securities. So if youre a Malaysian citizen and you sell a property after holding it for four years you would be liable to pay RPGT at 20 of the chargeable gain.

Estate Planning Estate Planning Home Buying Estates

The 1 Mistake In Stock Investing Regrettably As I Write The First Thing That Most People Do When Investing In Investing In Stocks Investing Stock Market

Last Will And Testament Concept Will And Testament Last Will And Testament Estate Planning

Free Photo Successful Business Man Signing Documents In A Modern Office Successful Business Man Success Business Free Photos

The Recent 2019 Budget Tabling Has Put Forth Several New Measures Particularly In Property Investment There Is Now A 5 Investing Budgeting Property Investor

5 Commonly Used Financial Oxymorons Among Malaysians

Have You Heard Of The 5 Key Personal Finance Ratios These 5 Keys Cover Everything From Debt Savings And Insu Financial Independence Personal Finance Finance

Sample Letter Of Intent Letter Of Intent Letter Sample Letter Example

Difference Between Informative Net Profit Profit

Gold As An Investment Gold Investments Investing Buying Gold

Real Property Gains Tax Rpgt Malaysia Malaysia Property Tax

Malaysia Will Writer Funeral Wishes Writing Services Hand Lettering

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com Investing Property Investor Investment Property

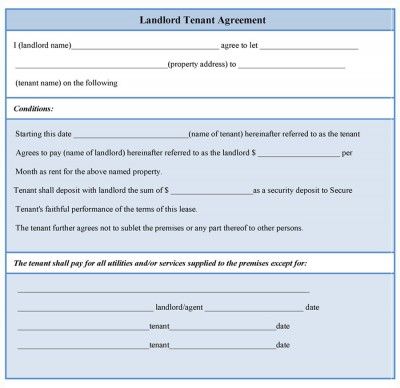

Landlord Tenant Agreement Form Sample Forms Being A Landlord Landlord Tenant Room Rental Agreement

Real Property Gains Tax Portal Jabatan Penilaian Dan Perkhidmatan Harta Malaysia Property Management Taxact Management

Do The Math Bussiness Business Ideas Entrepreneur Entrepreneur Infographic Business Money